The Role of Crypto Wallets

Crypto wallets serve as fundamental tools in the world of digital finance, offering mechanisms for managing and securing digital assets. Contrary to a common misconception, crypto wallets do not store cryptocurrencies directly; instead, they hold the private keys that are necessary for accessing and managing these funds on the blockchain. Comprehending the distinction between various types of crypto wallets is vital for both newcomers and experienced users in the cryptocurrency arena.

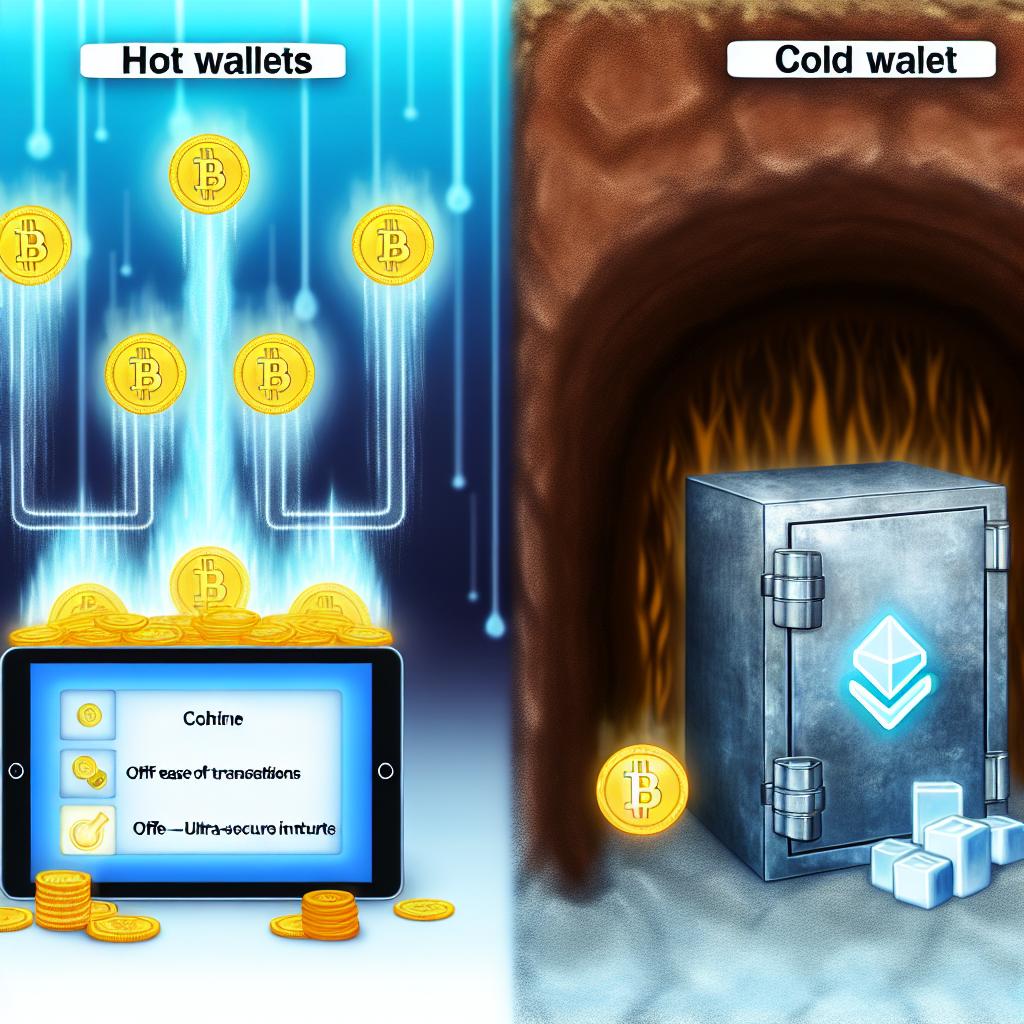

Hot Wallets

Hot wallets are digital storage solutions that maintain an active connection to the internet. This connectivity allows them to provide increased accessibility and convenience for transactions, making them indispensable for regular interactions with cryptocurrencies like Bitcoin, Ethereum, and others.

Accessibility and Convenience

Hot wallets stand out due to their ability to offer users rapid and straightforward access to their digital currencies. With such wallets, individuals can execute transactions efficiently without the need to connect additional external devices or perform complex procedures. This speedy access is particularly beneficial for those who engage in daily trading or use cryptocurrencies for routine spending. Prominent platforms like Coinbase and Binance provide widely used hot wallet solutions, integrated seamlessly into their exchange services.

Security Considerations

Despite their benefits in terms of convenience, hot wallets come with inherent vulnerabilities due to their continuous internet connection. This constant accessibility makes them potential targets for hacking attempts and malware. Therefore, it is essential for users of hot wallets to enhance their security posture through robust measures. Implementing strong, unique passwords and enabling two-factor authentication are recommended steps for users to secure their digital assets further. By doing so, users can mitigate some of the security risks while benefiting from the advantages of hot wallets.

Cold Wallets

Cold wallets, often referred to as offline wallets, provide an alternative method of storing digital assets with enhanced security. By eliminating an internet connection, cold wallets substantially reduce the risk of unauthorized access to cryptocurrency holdings. These wallets are particularly suited for long-term storage and safeguarding substantial quantities of digital currency.

Enhanced Security

The core benefit of cold wallets lies in their improved security features. Their offline status renders them immune to online threats, making them an ideal choice for users looking to store crypto assets without frequent access. Cold wallets encompass hardware wallets and paper wallets, each serving the purpose of protecting private keys by maintaining an offline environment.

Types of Cold Wallets

Hardware wallets like Trezor and Ledger represent one category of cold storage. These are physical devices engineered specifically to protect private keys, facilitating users to authorize transactions safely without exposing sensitive information to internet threats. On another front, paper wallets offer a straightforward offline storage solution by allowing users to generate and print their private keys on paper. The paper can then be stashed in a safe location, ensuring that the keys remain secure from digital attacks. Both these types provide an extra layer of security for those prioritizing the safeguarding of their assets over convenience.

Choosing the Right Wallet

Selecting the appropriate crypto wallet hinges upon an individual’s unique needs, preferences, and risk tolerance. For active traders or individuals who frequently utilize cryptocurrencies for transactions, the advantages of hot wallets — primarily quick accessibility — are often seen as indispensable. On the other hand, those who value security and seek to hold their digital currencies for an extended period without regular transactions might favor the robust protection offered by cold wallets.

Balancing Convenience and Security

For those who wish to strike a balance between convenience and security, a combination approach can be particularly effective. By keeping a smaller portion of their holdings readily accessible in a hot wallet for everyday use, users can enjoy the benefits of ease of use and immediate availability. Simultaneously, they can store the majority of their assets in a cold wallet, thus optimizing for security by insulating their larger holdings from potential online threats. This dual-wallet strategy allows users to cater to both short-term operational needs and long-term asset protection efficiently.

Conclusion

In conclusion, understanding the differences between hot wallets and cold wallets is foundational for anyone involved in cryptocurrency management and investment. Each type of wallet offers distinct advantages and has its limitations, typically revolving around the trade-off between security and accessibility. Therefore, wisely selecting the appropriate wallet or combination of wallets plays a crucial role in achieving a successful and secure cryptocurrency experience, whether one is an active trader or a long-term holder. By keeping informed about these wallet types, users can make more strategic choices that align with their specific goals and enhance their overall crypto experience.